Europe’s ETF market exploded over the past five years. Fees dropped, regulation tightened, and UCITS funds became the standard way Europeans build long-term portfolios. If you’re starting in 2026, here’s a clear look at the best options.

Disclaimer:

The information provided on Finorum is for educational and informational purposes only and does not constitute financial, investment, or tax advice.

Investing involves risk, including the potential loss of capital.

Always conduct your own research or consult a qualified financial advisor before making investment decisions.

Finorum does not promote or endorse any specific financial products or institutions.

Why UCITS ETFs Are the Best Choice for European Investors (2026)

If you’re based in Europe and plan to start investing in 2026, chances are you’ve already come across the term UCITS ETF. These funds have quietly become the best UCITS ETFs in Europe 2026 for both beginners and experienced investors — and for good reason.

By mid-2025, UCITS ETFs managed more than €2.7 trillion in assets across Europe (EFAMA Market Insights, 2025). Their rapid growth over the past few years is no coincidence: they combine strong EU regulation, low costs, and global diversification, making them one of the safest and most practical ways to invest for both small and large portfolios.

Imagine Anna, a 28-year-old from Spain, starting her journey with just €1,000. Instead of picking single stocks, she buys one global UCITS ETF that gives her exposure to thousands of companies worldwide. That’s the power of UCITS — accessibility without complexity, and a structure that has become the go-to option for millions of European investors.

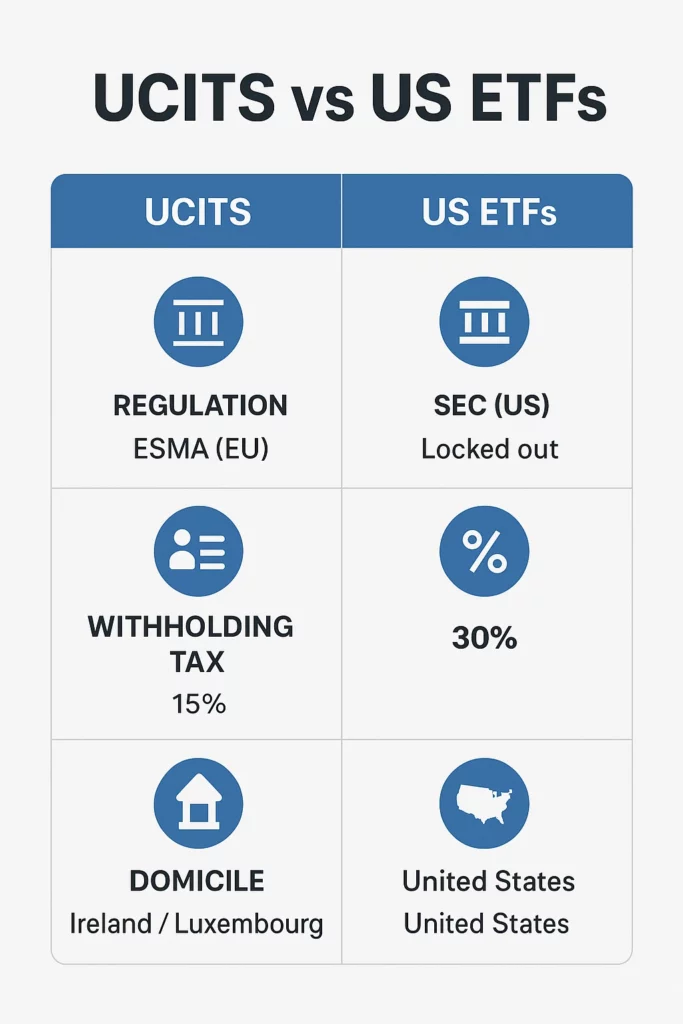

UCITS vs US ETFs: Regulation and Tax Differences Explained

UCITS vs US-domiciled ETFs – key differences for European investors in 2026 (regulation, investor protection, tax treatment and availability under PRIIPs).

UCITS stands for Undertakings for Collective Investment in Transferable Securities — the European Union’s strict framework for regulated investment funds. In practice, this means:

- Legal protection → UCITS ETFs must follow ESMA guidelines on diversification, disclosure, and risk management.

- Transparency → Every fund must publish a Key Information Document (KID) that clearly shows its costs, risks, and holdings.

- Accessibility → Many European brokers let you start investing with as little as €1 (justETF, 2025).

- Tax efficiency → ETFs domiciled in Ireland or Luxembourg benefit from lower US dividend withholding tax, especially on American equity exposure (PwC Tax Summaries, 2025).

Think of UCITS ETFs as Europe’s investment passport. Whether you’re in Germany, France, Poland, or any EU country, you can access the same regulated funds under a unified framework of investor protection rules.

Key Benefits of UCITS ETFs for Beginners in Europe

UCITS ETFs have become the backbone of European investing, trusted by both retail and institutional investors. According to EFAMA (2025), they now account for more than 60% of all new fund inflows in Europe. Each year, over 100 new UCITS ETFs are launched across European exchanges (justETF, 2025), reflecting how innovation and demand continue to accelerate.

Investors increasingly choose UCITS ETFs because they offer a unique balance of safety, transparency, and long-term performance within a robust European regulatory framework. Here are the main reasons why so many European investors rely on them as their core investment option.

Main Advantages of UCITS ETFs

- Broad diversification — A single ETF such as the Vanguard FTSE All-World UCITS (VWCE) spreads your investment across more than 3,700 companies in over 60 countries (justETF, 2025).

- Low costs — Total Expense Ratios (TER) typically range between 0.07% and 0.25%, compared to 1–2% for many traditional mutual funds (Morningstar, 2025).

- Strong regulation — All UCITS ETFs comply with ESMA guidelines on diversification, disclosure, and risk management, offering investors a higher level of protection than unregulated products.

- Tax efficiency — Many UCITS ETFs are domiciled in Ireland, benefiting from reduced US dividend withholding tax (15% instead of 30%) under bilateral treaties (PwC Tax Summaries, 2025).

- Liquidity — UCITS ETFs trade daily on Xetra, Euronext, the London Stock Exchange, and Borsa Italiana, with high volumes and tight bid–ask spreads (Trustnet, 2025).

Investor Profiles

- Anna (28, Spain) — Focused on long-term growth, she invests in an accumulating global UCITS ETF, where dividends are automatically reinvested.

- Markus (45, Germany) — Seeks a mix of stability and income. He prefers distributing ETFs that pay quarterly dividends, balancing them with bond ETFs for consistency.

- Elisabeth (65, Austria) — Retired and focused on reliability. She holds corporate bond ETFs and high-dividend UCITS ETFs to generate predictable income.

Accumulating vs. Distributing UCITS ETFs

| Feature | Accumulating ETF | Distributing ETF |

|---|---|---|

| Dividends | Reinvested automatically | Paid out in cash |

| Best for | Growth-focused investors (Anna) | Income-focused investors (Markus, Elisabeth) |

| Taxation | Tax on gains upon sale (varies by country) | Dividend tax applied annually |

Tip: Choose accumulating ETFs if you don’t need immediate cash flow. They automatically reinvest dividends, allowing your returns to compound and often reducing yearly dividend taxation in many European countries.

In Germany, accumulating ETFs are typically more tax-efficient for younger investors, while in Spain, distributing ETFs may create annual tax liabilities. Other EU countries follow similar principles, but rates and thresholds vary — always verify your local tax rules (KPMG EU Tax Centre, 2025).

Best UCITS ETFs in 2026: Top Funds to Buy Now

With more than 2,000 UCITS ETFs listed across Europe as of early 2026 (justETF, 2025), choosing the right one can feel overwhelming. The following list highlights the best UCITS ETFs in Europe 2026, selected based on cost, liquidity, diversification, and popularity among European brokers.

Top UCITS ETFs in Europe (2026)

| ETF Name | Ticker | TER | Domicile | Focus | Type |

|---|---|---|---|---|---|

| Vanguard FTSE All-World UCITS | VWCE | 0.22% | Ireland | Global equities | Accumulating |

| iShares Core MSCI World UCITS | IWDA | 0.20% | Ireland | Developed markets | Accumulating |

| SPDR S&P 500 UCITS | SPY5 | 0.09% | Ireland | US large-cap | Distributing |

| Xtrackers MSCI Emerging Markets UCITS | XMME | 0.18% | Luxembourg | Emerging markets | Accumulating |

| iShares Core Global Aggregate Bond UCITS | AGGH | 0.10% | Ireland | Global bonds | Accumulating |

| Lyxor MSCI Europe UCITS | MEUD | 0.12% | Luxembourg | European equities | Distributing |

| Amundi MSCI EM ESG Leaders | AEEM | 0.18% | Ireland | ESG emerging markets | Accumulating |

| iShares STOXX Europe 600 UCITS | EXSA | 0.12% | Ireland | Pan-European equities | Distributing |

| iShares Global Clean Energy UCITS | INRG | 0.65% | Ireland | Renewable energy | Distributing |

Overview of the best UCITS ETFs in Europe 2026, based on cost, liquidity, and diversification.

Quick Reviews of the Best UCITS ETFs

- VWCE (Vanguard FTSE All-World) — Covers around 90% of global stock market capitalization, making it a complete global solution for most investors. It’s also the most popular ETF in Trade Republic’s savings plans in 2025 (justETF, 2025). For Anna, choosing VWCE meant she didn’t need to worry about individual countries — one ETF gave her instant global exposure.

- IWDA (iShares MSCI World) — Focused exclusively on developed markets. Slightly cheaper TER and highly liquid on Euronext and Xetra, making it an excellent choice for cost-conscious investors.

- SPY5 (SPDR S&P 500 UCITS) — Classic exposure to the US economy. As a distributing ETF, it remains a favourite among investors seeking regular dividend income.

- XMME (Xtrackers MSCI Emerging Markets) — Access to over 1,400 companies in emerging markets. Offers higher long-term growth potential, but with increased volatility.

- AGGH (iShares Core Global Aggregate Bond) — Provides broad, diversified global bond exposure. Commonly used in conservative and balanced portfolios for stability and predictable returns.

- MEUD (Lyxor MSCI Europe) — Tracks 15 major European markets, ideal for investors who prefer a regional focus and moderate risk profile.

- AEEM (Amundi MSCI EM ESG Leaders) — Combines exposure to emerging markets with ESG screening, reflecting a growing shift toward sustainable investing among younger Europeans.

- EXSA (iShares STOXX Europe 600) — A low-cost ETF that captures the performance of the wider European equity market — simple, diversified, and liquid.

- INRG (iShares Global Clean Energy) — A thematic ETF focused on renewable energy companies. Its higher TER reflects the niche focus, but it remains appealing for investors looking to align with Europe’s clean energy transition.

A Simple Starting Point

You don’t need a portfolio of ten ETFs. For most investors, one global UCITS ETF — such as VWCE or IWDA — already provides broad diversification across regions and sectors.

Adding bonds, emerging markets, or a thematic ETF (for example, clean energy or ESG) is optional. It depends on your goals, time horizon, and risk tolerance. The simpler your portfolio, the easier it is to stay consistent and focused over time.

How to Choose the Right UCITS ETF for Your Portfolio

With thousands of ETFs available in 2026, even the best UCITS ETFs in Europe can feel confusing. The good news is that once you focus on a few essential criteria, choosing the right UCITS ETF becomes much simpler.

Key Factors to Consider

- Domicile — Most UCITS ETFs are domiciled in Ireland or Luxembourg. Ireland alone hosts over 60% of all UCITS ETF assets (justETF, 2025). Thanks to favourable tax treaties, Ireland often reduces US dividend withholding tax from 30% to 15% (PwC, 2025).

- Costs (TER) — Lower fees are attractive, but they tell only part of the story. Always check both the Total Expense Ratio (TER) and the tracking difference, which measures how closely an ETF mirrors its benchmark index.

- Size and liquidity — Larger funds, typically those with over €1 billion in assets under management, tend to be more liquid. This usually means tighter bid–ask spreads and lower trading costs (justETF, 2025).

- Distribution type — Choose accumulating ETFs if you want automatic reinvestment of dividends, or distributing ETFs if you prefer regular cash payouts.

- Investment horizon — For long-term growth, a global accumulating ETF is often the simplest choice. For shorter-term goals or regular income, bond ETFs or distributing funds may fit better.

Tip: Don’t focus only on the TER. A fund with a 0.10% TER but poor tracking difference can still underperform a 0.20% ETF. Always review both metrics before deciding.

Checklist When Selecting an ETF

| Factor | Why It Matters | Example |

|---|---|---|

| Domicile | Affects dividend taxation | Ireland often better for US equity ETFs |

| TER | Lower fees = higher net return | IWDA 0.20% vs active fund 1.5% |

| Tracking difference | Reveals “real cost” vs the index | VWCE ~0.22% + 0.05% TD |

| Fund size (AUM) | Larger = more liquid and stable | VWCE > €20bn AUM |

| Type | Accumulating vs. distributing | Anna = accumulating, Markus = distributing |

Reliable sources such as justETF and Morningstar publish tracking difference data monthly, helping investors compare ETFs more accurately (Morningstar, 2025).

A Practical Example

For Markus, choosing a distributing ETF domiciled in Ireland brought two clear benefits: lower US withholding tax on dividends and a steady quarterly payout to supplement his family income.

For him, the decision wasn’t only about cost — it was about predictability, tax efficiency, and aligning the investment with real life.

Where to Buy UCITS ETFs in Europe: Best Brokers 2026

No matter which ETF you choose, you’ll need a broker or investment platform to actually buy it. Picking the right one is just as important as choosing the ETF itself — because fees, regulation, and usability can make a big difference over time in 2026.

If you’re searching for where to buy UCITS ETFs in Europe 2026, here are the platforms most investors across the EU rely on today.

Regulation Matters

All brokers operating in the EU must comply with MiFID II and ESMA rules. National regulators such as BaFin (Germany), AMF (France) and CNMV (Spain) enforce these standards locally.

Most EU brokers also participate in Investor Compensation Schemes, which typically protect up to €20,000 in client assets if a broker fails (European Commission – Investor Compensation Schemes).

Important: Always choose a broker regulated within the EU. You can verify this on your national regulator’s website — for example, BaFin in Germany or CNMV in Spain. Avoid unlicensed “finfluencers” or offshore platforms with unclear oversight.

Safety reminder: Even when your broker is regulated, ETF investments are not guaranteed. Market risk always remains — compensation schemes protect you only against broker failure, not against losses in your portfolio. Understanding this distinction is key to managing expectations.

Best Brokers for UCITS ETFs in 2026

| Broker | Fees | Min. Deposit | Best For | Regulator |

|---|---|---|---|---|

| Trade Republic | ~€1 per trade | €1 | Beginners, ETF savings plans | BaFin (Germany) |

| DEGIRO | Very low (ETFs from €0) | €0 | Wide ETF selection | AFM (Netherlands) |

| Scalable Capital | Free plan or €2.99/month | €1 | Automated savings, easy interface | BaFin (Germany) |

| Interactive Brokers (IBKR) | Ultra-low global fees | €100 | Advanced investors | Central Bank of Ireland |

| eToro | Free stocks/ETFs, spreads on others | €50 | Social trading, multi-assets | CySEC (Cyprus) |

| Revolut / N26 Invest | Free up to a limit | €1 | Micro-investments via bank app | Local EU regulators |

Comparison of the best brokers for UCITS ETFs in Europe 2026, based on cost, regulation, and accessibility.

In 2025, Trade Republic surpassed 4 million ETF savings plans across Europe, becoming the most popular platform for small, automated investments (justETF – ETF Savings Plan Statistics).

Mobile Apps and Usability

- Trade Republic / Scalable Capital — intuitive, beginner-friendly mobile apps, ideal for setting up automated ETF savings plans.

- Revolut / N26 Invest — micro-investing directly through your bank app, perfect for younger or time-constrained investors.

- Interactive Brokers — highly advanced platform with global access, though the interface can feel complex for beginners.

Investor Examples

- Anna (Spain) — opens a Trade Republic account and sets up a €50/month ETF savings plan into VWCE.

- Markus (Germany) — uses DEGIRO for a wider range of ETFs and bond options at very low cost.

- Elisabeth (Austria) — prefers the simplicity of N26 Invest. Even if fees are slightly higher, the comfort of using her own bank app outweighs saving a few euros per trade.

Costs and Long-Term Impact

Many traditional banks in Spain and Italy still charge €10–15 per ETF trade.

In contrast, online brokers such as Trade Republic or DEGIRO typically charge €1 or less.

Over 10–15 years, that difference can easily amount to thousands of euros in saved costs (justETF – Broker Comparison).

Practical Tips for New Investors

- Use broker resources — Platforms like DEGIRO and Scalable Capital offer free webinars, tutorials, and investor learning centres (DEGIRO Academy).

- Watch for hidden fees — Currency conversion, withdrawal, or inactivity fees can vary significantly. Always read the fine print.

- Start small and automate — A recurring ETF savings plan of €25–50 per month is often the easiest and most effective way to begin investing.

How to Buy Your First UCITS ETF (Step by Step)

Once you’ve chosen a regulated broker, buying your first ETF is straightforward:

- Choose a broker — compare fees, regulation, and available products.

- Open an account — verify your identity (KYC is mandatory under EU law).

- Deposit funds — via SEPA transfer or card payment.

- Search for your ETF — by ticker or ISIN (e.g. VWCE, IWDA, SPY5).

- Place an order — select market order (immediate) or limit order (set your price).

- Store securely — ETFs remain in custody with your broker’s partner bank, protected under EU investor rules.

- Automate contributions — set up an ETF savings plan for consistent monthly investing (available from €25/month with Trade Republic or Scalable Capital).

UCITS ETFs Taxation in Europe 2026 (Country Snapshots)

Even the best UCITS ETFs in Europe 2026 can produce very different net returns depending on where you live. That’s because tax rules on capital gains and dividends vary widely across European countries.

Understanding UCITS ETF taxation in Europe 2026 is essential before you invest.

Comparison of Capital Gains and Dividend Tax Rates Across Europe (2026)

| Country | Capital Gains Tax (CGT) | Dividend Tax | Notes |

|---|---|---|---|

| Germany | 25% flat (“Abgeltungsteuer”) | 25% flat | Plus solidarity surcharge (~5.5% of tax) |

| France | 30% flat (“Prélèvement Forfaitaire Unique”) | 30% flat | Combined rate for capital gains and dividends |

| Spain | 19–28% progressive | 19–28% progressive | 19% up to €6k, 21% up to €50k, 23% up to €200k, 28% above |

| Italy | 26% flat | 26% flat | Same rate for both income types |

| Ireland | 33% flat | 25% flat | Europe’s highest CGT rate, offset by strong treaty advantages |

| Belgium | 10% CGT (from 2026) | 30% dividend tax | Major reform — Belgium previously had no CGT on shares |

Sources: PwC Worldwide Tax Summaries · KPMG EU Tax Centre · Regulated United Europe – Tax Insights.

Country Highlights

Germany

- CGT and dividends: 25% flat tax (+5.5% solidarity surcharge)

- Perk: €1,000 Sparer-Pauschbetrag allowance tax-free each year

Spain

- CGT and dividends: 19–28% progressive

- Perk: Accumulating ETFs defer annual dividend taxation until sale

Ireland

- CGT: 33% (highest in Europe)

- Dividends: 25% flat

- Perk: Still the most common ETF domicile due to favourable US tax treaties that reduce withholding tax for Irish-domiciled funds

Avoiding Double Taxation

Be cautious about double taxation.

Many brokers automatically withhold foreign dividend tax at the source — for example, 15% US withholding plus your local dividend tax.

To avoid paying twice, check whether your country has a double taxation treaty with the fund’s domicile (usually Ireland or Luxembourg). Most Irish-domiciled ETFs already benefit from treaty reductions with the US, but you should confirm this with your broker or tax advisor.

Key Tax Trends Across Europe

- Ireland — Least attractive for CGT (33%), yet remains the leading ETF domicile due to its treaty advantages.

- Germany — The 25% flat rate can be more favourable than Spain’s progressive scale for higher earners.

- Belgium — 2026 introduces a new 10% CGT on shares, marking a major policy shift (KPMG EU Tax Centre).

- EU-wide — Under MiCA and DAC8 regulations, EU brokers must automatically report investor transactions to national tax authorities, improving transparency and compliance.

Additional Considerations for Investors

- Tax incentives and savings accounts — Some EU countries offer tax advantages for long-term investing. In Germany, ETFs can be held within Riester-Rente or Rürup pension plans, while in Spain, certain pension accounts offer deductions (AEAT – Spanish Tax Agency).

- Currency and broker choice — If your ETF is denominated in USD but your account is in EUR, you may face conversion costs. Brokers like DEGIRO or Interactive Brokers often provide better FX rates than traditional banks.

- Tax filing and reporting — Consider using professional tools (e.g. WISO Steuer) or a licensed tax advisor for accurate reporting and relief claims.

- Upcoming reforms — Belgium’s 10% CGT from 2026 may set a precedent. Other EU countries are already reviewing similar updates (KPMG EU Tax Centre, 2025).

Investor Examples

- Anna (Spain) — Invests in an accumulating ETF. By avoiding annual dividend taxation, she lets her returns compound and pays 19–28% only upon sale — a major long-term advantage.

- Markus (Germany) — Invests in distributing ETFs taxed at 25%. He benefits from the €1,000 Sparer-Pauschbetrag allowance and considers using a retirement savings account for additional tax efficiency.

- Elisabeth (Austria) — Pays 27.5% on both dividends and bond interest but prefers predictable income despite the tax burden.

Tax rules evolve constantly. Belgium’s introduction of a 10% CGT from 2026 is only one example of how quickly national systems change.

Always check the latest local tax laws or consult a qualified tax advisor before investing.

Tax efficiency may not sound exciting, but over decades, it can make a bigger difference to your returns than market timing.

Example UCITS ETF Portfolios (€1,000 – €10,000)

Theory is useful, but seeing how a real portfolio looks — especially for beginners — makes everything easier to understand.

Below are example UCITS ETF portfolios for 2026, designed for different levels of risk tolerance and investor profiles across Europe.

Conservative Portfolio (Focus on Stability)

- 40% → Global bond ETF (iShares Core Global Aggregate Bond – AGGH)

- 20% → Euro government bond ETF (iShares Euro Government Bond 1–3yr – EUNA)

- 25% → European equity ETF (Lyxor MSCI Europe – MEUD)

- 15% → Dividend UCITS ETF (SPDR S&P Euro Dividend Aristocrats – EUDI)

Ideal for: Retirees or cautious investors who want to preserve capital and generate steady income.

Elisabeth (65, Austria) holds a conservative mix. For her, steady coupon payments and dividends are more valuable than chasing higher returns.

Balanced Portfolio (Growth and Stability)

- 60% → Global equity ETF (Vanguard FTSE All-World – VWCE)

- 20% → Global bond ETF (AGGH)

- 10% → Emerging markets ETF (Xtrackers MSCI EM – XMME)

- 10% → European dividend ETF (iShares STOXX Europe 600 – EXSA)

Ideal for: Mid-career investors balancing long-term growth with stability.

Markus (45, Germany) enjoys receiving a quarterly dividend from EXSA, which feels like a “mini paycheck” from his investments, while most of his money compounds in VWCE.

Growth Portfolio (High Risk, Long Horizon)

- 70% → Global equity ETF (VWCE)

- 10% → Emerging markets ETF (Amundi MSCI EM ESG Leaders – AEEM)

- 10% → Thematic ETF (iShares Global Clean Energy – INRG)

- 10% → Small-cap ETF (SPDR MSCI Europe Small Cap – ZPRS)

Ideal for: Young investors with decades ahead who can handle volatility in pursuit of higher potential returns.

Anna (28, Spain) invests for the long term. Watching her €1,000 gradually grow in VWCE motivates her to keep adding €50 per month through her ETF savings plan.

Quick Comparison of Example Portfolios

| Portfolio Type | Allocation | Expected Annual Return* | Risk Level | Liquidity |

|---|---|---|---|---|

| Conservative | 60% bonds, 40% equities/dividends | 3–4% | Low | High |

| Balanced | 60% equities, 40% bonds/dividends | 5–6% | Medium | High |

| Growth | 80–90% equities, 10–20% thematic/EM | 6–9% | High | High |

Overview of example UCITS ETF portfolios in Europe 2026. Based on long-term historical averages from Morningstar – Market Returns and justETF – Portfolio Strategies. Returns are not guaranteed and markets can be volatile.

Portfolio Management Tips

- Risk management and rebalancing — Review your portfolio once or twice a year. If equities grow faster than bonds, rebalance to maintain your target allocation.

- Diversification — Don’t just diversify by asset class. Spread across regions (US, Europe, EM), sectors (technology, healthcare, energy) and currencies (EUR, USD, GBP).

- Costs and taxes — Trading fees, dividend withholding taxes, and currency conversion costs all affect returns. Include them in your long-term plan.

- Long-term mindset — Growth portfolios can drop 20–30% in bad years. Historically, those who stayed invested recovered within two to three years. Staying disciplined is key to achieving higher returns over time (BaFin – Investor Education).

- Tracking and analysis — Use platforms like justETF Portfolio Tracker or your broker’s app to monitor performance, dividends, and allocation over time.

Even with €1,000, you can build a diversified ETF portfolio.

Thanks to fractional investing and ETF savings plans (available from €25 per month), diversification is no longer reserved for large investors (justETF – Savings Plans).

Small, consistent contributions — not market timing — are what truly drive long-term results

Common ETF Mistakes and How to Avoid Them in 2026

Even the best UCITS ETFs in Europe 2026 won’t help if you fall into the same traps many beginners across Europe make.

Here are the most common ETF investing mistakes in 2026 — and how to avoid them before they cost you time and returns.

1. Ignoring Costs and Hidden Fees

A TER of 0.10% versus 0.30% may seem small, but over a 20-year period it can mean thousands of euros lost through compounded costs.

Always compare the Total Expense Ratio (TER), the tracking difference, and broker fees together before investing.

Useful tools: justETF – ETF Screener, Morningstar – ETFs.

2. Putting All Your Money into One ETF or Stock

Concentration risk is one of the biggest mistakes new investors make.

Relying on a single ETF — especially a niche or thematic one — can expose you to unnecessary volatility.

Start with a broad, diversified UCITS ETF, and only later consider smaller or thematic allocations.

3. Chasing Past Performance

Past performance rarely predicts future results.

Yesterday’s top-performing ETFs often underperform later — as shown by the S&P SPIVA Europe Persistence Scorecard.

Focus on diversification, low cost, and consistency, not short-term winners.

4. Forgetting About Liquidity

Smaller or niche ETFs can have low trading volumes and wider bid–ask spreads, making them more expensive to buy or sell.

Always check a fund’s average daily volume and spread before investing.

Larger, established ETFs are usually cheaper and more liquid.

5. Overlooking Taxes

Taxes can quietly erode your returns more than market swings.

Dividends and capital gains are treated differently across Europe, and tax rules vary by country.

Accumulating ETFs often defer annual dividend taxation until sale, making them more efficient for long-term compounding.

Quick references: PwC Worldwide Tax Summaries, KPMG EU Tax Centre.

6. Using Unregulated Platforms or Following “Finfluencers”

Always verify that your broker or investing app is properly licensed in the EU.

Regulated brokers operate under MiFID II and ESMA supervision; unregulated platforms do not.

Helpful databases and warnings:

- CNMV – Entities not authorised (“boiler rooms”)

- ESMA – Social media alert on unauthorised financial ads (May 2025)

- BaFin – Company Search

According to ESMA, over 5,000 illegal financial platforms were identified across Europe between 2023–2025 — a reminder that regulation is your first layer of protection.

7. Neglecting Education and Discipline

Lack of knowledge and emotional control can be more damaging than market risk.

Avoid complex ETFs (like leveraged or inverse funds) until you fully understand how they work.

Focus on long-term habits, regular investing, and discipline before chasing returns.

Resources: BaFin – Consumers, ESMA – Investor Corner.

Practical Tips to Avoid These Mistakes

- Rebalance once or twice a year to keep your portfolio aligned with your goals.

- Track your performance using tools like justETF Portfolio Overview or your broker’s dashboard.

- Match ETFs to your risk tolerance — not every fund suits every investor.

- Keep it simple — complex products rarely outperform diversified core holdings.

- Stay informed through trusted regulators: ESMA, BaFin, CNMV, and other official investor education portals.

Good investing is about patience and discipline, not prediction — consistency is what truly drives long-term success.

Conclusion

Investing in UCITS ETFs in Europe 2026 is not about finding the next big trend — it’s about building stability, clarity, and long-term habits.

The same principles that guide the best investors remain timeless: diversify broadly, keep costs low, and stay consistent.

Europe’s ETF market is now more transparent and accessible than ever, with strong MiFID II and ESMA protections, low-cost brokers, and fractional investing options starting from just a few euros per month.

Whether you’re starting with €1,000 or building a larger portfolio, the key is to stay focused on what you can control — costs, discipline, and time in the market.

Your first ETF investment isn’t just financial — it’s educational.

Each contribution builds not only your portfolio, but also your confidence as an investor.

In the long run, the biggest return comes from what you learn along the way.

Key Takeaways

- Start simple — one or two global UCITS ETFs are enough to begin.

- Costs compound too — compare TER, tracking difference, and broker fees.

- Diversify globally — avoid concentration in one region or theme.

- Stay regulated — use EU-licensed brokers and verified investment platforms.

- Think long-term — time and consistency matter more than timing the market.

- Tax efficiency counts — check local capital gains and dividend tax rules.

- Rebalance annually — maintain your target allocation and control risk.

- Avoid hype — ignore short-term market noise and social media “tips.”

- Educate yourself — follow ESMA, BaFin, and CNMV investor resources.

- Consistency wins — small, regular investments outperform perfect timing.

FAQ — UCITS ETFs in Europe 2026

UCITS ETFs are European-regulated exchange-traded funds that follow strict rules on diversification, transparency, and investor protection under the UCITS Directive.

Yes — they are regulated under ESMA and national authorities (BaFin, AMF, CNMV). While market risk remains, investors benefit from strict oversight and segregation of client assets.

A broad global fund such as Vanguard FTSE All-World (VWCE) or iShares MSCI World (IWDA) is often considered a strong starting point due to global diversification and low costs.

Thanks to fractional investing and ETF savings plans, you can start with as little as €25–50 per month using platforms like Trade Republic or Scalable Capital.

They’re often cheaper and more transparent. UCITS ETFs trade like stocks and typically have lower management fees than actively managed mutual funds.

Tax rules differ by country. Most EU nations tax capital gains and dividends separately. Ireland- and Luxembourg-domiciled ETFs usually offer favourable treaty benefits.

Yes, but availability depends on your broker. Many non-EU investors use Ireland- or Luxembourg-domiciled ETFs because of strong regulation and global reach.

Accumulating ETFs reinvest dividends automatically, while distributing ETFs pay them out in cash. Your choice depends on whether you want growth or regular income.

Top options include Trade Republic, DEGIRO, Scalable Capital, and Interactive Brokers — all EU-regulated with low fees and ETF savings plans.

Stay diversified, automate monthly contributions, and ignore short-term volatility.

Over time, discipline and consistency matter far more than market timing.

Iva Buće is a Master of Economics specializing in digital marketing and logistics. She combines analytical thinking with creativity to make financial and investment topics accessible to a broader audience. At Finorum, she focuses on translating complex economic concepts into clear, practical insights for everyday readers and investors.

Sources & References

EU regulations & taxation

- European Commission / Taxation & Customs — ESMA

- ESMA

- ESMA

- Investor Compensation Schemes

- Key Information Document (KID)

- MiFID II

- KPMG EU Tax Centre

- KPMG EU Tax Centre, 2025

- PwC Tax Summaries — PwC Worldwide Tax Summaries

- Rue.ee — Regulated United Europe – Tax Insights.