A € 1000 ETF portfolio in Europe offers one of the simplest and most cost-efficient ways for beginners to build global diversification under the UCITS framework.

Disclaimer:

The information provided on Finorum is for educational and informational purposes only and does not constitute financial, investment, or tax advice.

Investing involves risk, including the potential loss of capital.

Always conduct your own research or consult a qualified financial advisor before making investment decisions.

Finorum does not promote or endorse any specific financial products or institutions.

Introduction

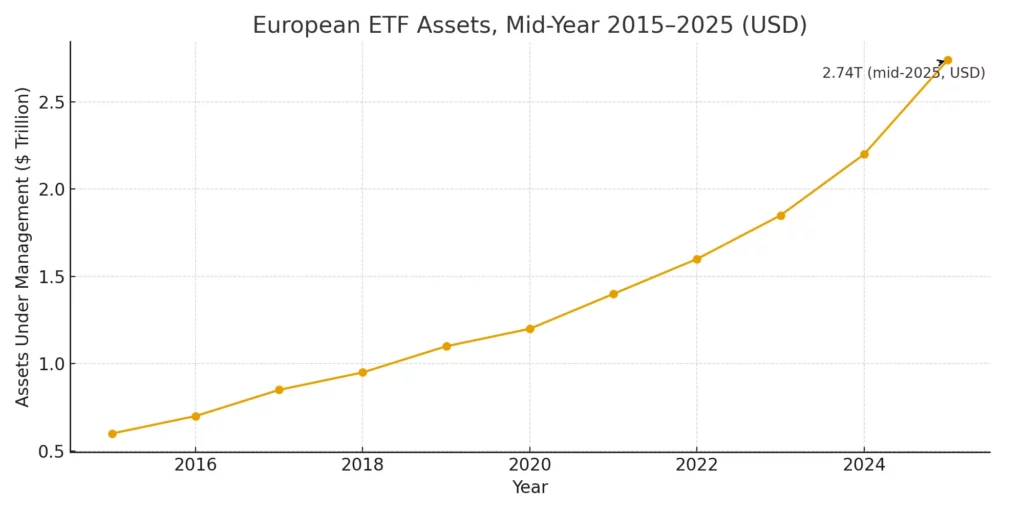

Most new investors assume €1000 is too little to build anything meaningful — yet Europe’s ETF landscape suggests the opposite. European ETFs held around $2.74 trillion in assets by mid-2025, according to ETFGI, and crossed the $3 trillion mark later that year. AUM growth at that scale doesn’t happen by accident; it reflects how UCITS structures — with ESMA oversight and predictable tax treatment — lowered the entry barrier for small portfolios.

And here’s a simple illustration. An investor who had put €1000 into an iShares Core S&P 500 UCITS ETF five years ago could easily see that position above €1500 today, depending on entry date and fees. No trading strategy. No timing. Just the basic UCITS framework doing its work.

So the real question is straightforward: how do you build a €1000 ETF portfolio in Europe that actually makes sense in 2026 — without turning it into a spreadsheet exercise?

In the sections that follow, we’ll unpack the choices that matter: which UCITS ETFs work well for small portfolios, how costs quietly reshape returns, and which European trends are driving ETF adoption. What’s interesting is that the framework often matters more than the amount itself.

European ETF assets have grown steadily from 2015 to mid-2025 — a trend that strengthens the case for building a €1000 ETF portfolio in Europe using low-cost UCITS funds.

Why Start with a €1000 ETF Portfolio?

Most people look at €1000 and assume it’s too modest for a proper portfolio. Yet across Europe, that amount sits exactly where many beginners start — and it often works better than a stock-picking approach. One trade can spread your money across hundreds of companies, sometimes thousands, through a broad UCITS index ETF.

Survey responses to ESMA’s 2025 Retail Investor Journey initiative, combined with industry data from EFAMA and justETF, point to a similar trend: a significant share of first-time European investors open accounts with well under €2000. Small sums aren’t unusual. They’re simply how most people get in.

The UCITS framework reinforces that logic. Four decades of European regulation — diversification rules, independent depositaries, mandatory disclosure, the cross-border passport — apply identically whether a portfolio holds €1000 or €100,000. For beginners, that consistency matters more than they often realise.

Accessibility has shifted as well. Trade Republic and eToro offer fractional ETF investing, while low-fee brokers such as DEGIRO pushed the cost of many ETF trades close to zero. The result is a setup where a €1000 ETF portfolio in Europe feels functional rather than restrictive. The bottleneck isn’t the amount; it’s choosing a coherent structure.

A simple starting point might look like this:

- 70% in a global equity UCITS ETF (broad regional and sector exposure)

- 30% in a bond UCITS ETF (a stabilising anchor during volatile periods)

And here’s the part beginners often miss — two ETFs are enough. More than that usually adds complexity, not diversification.

Fees, however, are non-negotiable. A TER of 0.10% versus 0.30% may sound small, but Vanguard’s long-term research shows how those gaps compound into meaningfully different outcomes. For a €1000 starting portfolio, unnecessary costs cut immediately into returns.

Short and simple.

This is an educational example, not personalised investment advice.

Understanding ETFs in the European Context

Before building any portfolio in Europe, one concept sits above the rest — UCITS. The framework has shaped European fund regulation for more than four decades, defining how diversification, disclosure and investor protection must work in practice. The clear majority of ETFs available to European retail investors follow the UCITS rulebook, which effectively makes it the default structure across the continent.

For anyone starting a €1000 ETF portfolio in Europe, this matters: the regulatory protections, oversight and documentation requirements apply uniformly, regardless of portfolio size. Many beginners don’t realise how unusual that is compared with other jurisdictions.

Why US ETFs Are Off Limits for Most Europeans

A familiar scenario plays out across Europe. Someone attempts to buy a popular US-listed ETF — and the broker declines the order.

The reason is PRIIPs.

Any product offered to EU retail investors must include a Key Information Document (KID) with standardised descriptions of risks, costs and performance scenarios. Most US ETF issuers don’t produce KIDs, since they don’t target the European retail market. Without a KID, brokers simply cannot list those ETFs for non-professional clients.

European investors therefore turn to UCITS equivalents on Xetra, Euronext, Borsa Italiana and other venues. The exposures usually mirror the US benchmarks closely; the regulatory wrapper is the main difference.

Who Really Dominates the European ETF Market?

A handful of issuers control most of the European ETF landscape:

- iShares (BlackRock) — still the region’s heavyweight, with the broadest product range.

- Amundi — a major European provider, strong in ESG and euro-denominated bond ETFs.

- Xtrackers (DWS) — known for cost-efficient core ETFs.

- Vanguard — popular for low-cost global equity trackers.

ETF providers’ market share figures from ETFGI place these four well above everyone else, which is why many beginners inevitably end up holding at least one of their ETFs — not by brand preference, but by market structure.

The Rise of Active UCITS ETFs

While European portfolios remain anchored in passive strategies, active UCITS ETFs have expanded quickly. AUM grew into the tens of billions by late 2024, albeit from a small base, and the category still represents only a few percent of the UCITS ETF universe. Their fees — often 0.30–0.70% — sit between passive ETFs and traditional active funds.

They broaden the toolkit. But at the €1000 level, passive UCITS ETFs remain the most practical foundation.

UCITS vs US ETFs: What Changes for European Investors?

| Feature | UCITS ETFs (Europe) | US ETFs (Global) |

|---|---|---|

| Accessibility | Offered by EU brokers; KID available | Restricted for EU retail investors (no KID) |

| Regulation | UCITS: diversification rules, depositary oversight, detailed disclosure | SEC-regulated, but no EU documentation requirements |

| Taxation | Typically ~15% US withholding inside Irish-domiciled funds; no exposure to US estate tax | Up to 30% dividend withholding + potential US estate tax above $60,000 |

| Currency | EUR and USD listings available | USD only |

| TER Range | ~0.07–0.20% | ~0.03–0.07% (lower, but inaccessible to EU retail) |

| Market Trends | Growth in ESG and Active UCITS | Dominated by ultra-low-cost passive giants |

These figures are directional rather than universal — the final tax outcome always depends on the investor’s country of residence.

Case Study: Marta from Spain

Marta, a 28-year-old from Madrid, tried to buy the US-listed Vanguard S&P 500 ETF. Her order was blocked because the ETF has no PRIIPs-compliant KID. She redirected her €1000 into the iShares Core S&P 500 UCITS ETF on Xetra — similar exposure, clearer disclosures and no US estate tax considerations. A small administrative detail ended up shaping her entire entry into investing.

When browsing ETF listings, always check whether the fund carries the UCITS label. It avoids regulatory surprises and ensures the fund fits within Europe’s tax and disclosure rules. Many newcomers skip this step — until the broker declines their order.

ETF Strategies for Beginners with €1000

Once the basics of UCITS ETFs are clear, one question becomes unavoidable: how do you divide €1000 without turning the portfolio into a puzzle? At this size, simplicity isn’t a nice-to-have — it’s structural. Too many beginners buy five or six ETFs, only to discover they’ve built an expensive, overlapping collection that behaves just like one global fund.

Most don’t need that. Honestly.

The Core–Satellite Logic

A structure that works well for small portfolios is the core–satellite approach.

- Core (70–80%) — a broad, low-cost global equity UCITS ETF such as iShares Core MSCI World UCITS ETF (IWDA/SWDA). It typically holds around 1,300–1,500 large and mid-cap stocks across more than 20 developed markets. This becomes the engine of the portfolio.

- Satellite (20–30%) — a stabiliser (e.g., a euro government bond ETF like Xtrackers Euro Government Bond UCITS ETF – EUNA) or a targeted tilt (e.g., an Amundi MSCI Europe ESG UCITS ETF). These satellites adjust risk or add flavour without redefining the whole structure.

One early decision worth noting: accumulating (Acc) vs distributing (Dist) share classes. Most beginners choose Acc because dividends are reinvested automatically, avoiding small idle cash balances.

Example Allocation for a €1000 ETF Portfolio

- €700 → iShares Core MSCI World UCITS ETF (IWDA/SWDA) — broad global exposure.

- €200 → Xtrackers Euro Government Bond UCITS ETF (EUNA) — a calmer anchor during volatile periods.

- €100 → Amundi MSCI Europe ESG UCITS ETF (current variants include Leaders/Selection share classes) — a small ESG-tilted satellite.

Alternatives often used by beginners:

Short and clean.

Two ETFs already work. Three is still coherent. More than that tends to dilute impact — the maths simply doesn’t justify it at €1000.

Why Keeping It Simple Matters

A €1000 ETF portfolio in Europe doesn’t need sophistication — it needs clarity.

- Fees first. A TER of 0.20% vs 0.60% compounds into very different results over ten years. Vanguard’s UCITS cost analyses show this repeatedly. At €1000, every extra basis point matters.

- Bond ETFs steady the portfolio. Lower return potential, yes — but also gentler drawdowns. A useful psychological stabiliser for beginners.

- Thematic ETFs are spice, not structure. High variance, higher narrative risk, best capped below 10–15% of the portfolio.

- Annual rebalancing prevents drift. If equities sprint ahead, trim slightly and return to target weights.

- Avoid overlap. Global and regional ETFs often hold the same companies; doubling exposure unintentionally is a common beginner mistake.

- Diversification reminder: one global UCITS ETF already covers more companies than most investors will ever analyse. Regional add-ons are optional, not required.

UCITS and PRIIPs rules help here by forcing clear disclosure of risks, costs and performance scenarios — beginners often underestimate how much that transparency reduces unpleasant surprises.

Case Study: Luca from Italy

Luca, 25, started with €1000 in late 2022 — 70% in global equities, 30% in euro bonds — and added €100 each month. By mid-2025, his portfolio sat above €4,200, lifted by steady equity markets and consistent contributions. The first €1000 helped him begin; the discipline kept him moving.

For small portfolios, lean beats complex. Two or three UCITS ETFs, TERs below 0.20%, and one annual rebalance — that’s more than enough to build a €1000 ETF portfolio in Europe that ages well. The habit matters as much as the allocation.

Luca’s projected €1000 ETF portfolio in Europe, assuming €100 per month and fluctuating quarterly returns — a hypothetical example based on a balanced UCITS ETF allocation, excluding taxes and fees.

Choosing the Right ETF

With a €1000 ETF portfolio in Europe, fund selection looks simple on the surface — until you realise how many “global” ETFs track different indices, use different domiciles or hide meaningful differences in structure. And that’s exactly where beginners start to hesitate. What matters first?

A few filters cut through the noise.

1. Start With the Index, Not the Brand

Two ETFs can appear identical yet behave differently because they follow different benchmarks.

MSCI World, FTSE Developed World, S&P Global 1200 — same universe, different construction rules.

A practical rule: choose a broad, well-established index with transparent methodology. MSCI and FTSE usually set the standard.

2. Check the UCITS Wrapper and Domicile

For a €1000 ETF portfolio in Europe, the legal wrapper isn’t a footnote — it determines what you can buy, how you’re taxed and what protections you receive.

Irish-domiciled UCITS ETFs often benefit from favourable treaty rates on US dividends, while Luxembourg UCITS follow a different treaty network. UCITS rules also impose diversification constraints, independent depositary oversight and strict disclosure. Dry, yes — but essential.

Non-UCITS fund? Skip it.

EU retail regulation does not treat it the same.

3. Understand Acc vs Dist Share Classes

One of the earliest decisions:

- Accumulating (Acc) — reinvests dividends automatically; ideal when every euro counts and cash drag matters.

- Distributing (Dist) — pays cash out, which may create taxable events depending on your jurisdiction.

Most beginners choose Acc simply because it keeps the portfolio tidy.

4. Compare TER… but Don’t Obsess Over It

A TER of 0.15% vs 0.20% won’t change your life.

But 0.60% vs 0.20% might.

Vanguard’s UCITS research shows that cost drag becomes one of the strongest predictors of long-term net return. The key is moderation: low enough to avoid leakage, not so obsessive that you ignore better structure or domiciles.

5. Look at Replication Method (Physical vs Synthetic)

Physical replication (full or sampled) dominates in core UCITS ETFs. It’s simple, intuitive and usually preferred by beginners.

Synthetic replication appears more in niche exposures — commodities, factor tilts, hard-to-access markets. It can be perfectly safe when properly collateralised, but it requires reading the fund’s documentation.

Not complicated — just worth knowing.

6. Check Securities Lending Policies

Many equity UCITS ETFs lend out a portion of their holdings to reduce costs. It’s standard industry practice and typically well-controlled, but policies differ. Some providers return most of the lending revenue to investors; others keep a larger share.

A quick glance at the factsheet tells you how it works.

This tiny detail often explains why two similar ETFs have slightly different TERs.

7. Focus on Liquidity and Spread — Not Just AUM

Beginners often equate size with quality. But high AUM doesn’t guarantee cheap execution.

Bid–ask spreads matter more.

A €2bn ETF with a 0.25% spread is more expensive to trade than a €500m ETF with a 0.05% spread. Liquidity lives in the spread, not the marketing brochure.

8. Avoid Overlapping ETFs

The classic mistake: buying a global ETF and then adding a regional ETF that holds many of the same companies. Overlap is real. It distorts your intended allocation and makes a €1000 portfolio unnecessarily noisy.

9. Read the KID and Factsheet (Yes, Really)

UCITS and PRIIPs require clear disclosure of:

- cost scenarios

- risk indicators

- benchmark methodology

- portfolio composition

It’s not thrilling reading, but the documents exist to prevent surprises — especially for small portfolios where mistakes hurt more.

A Simple Way to Decide

A clean decision framework for a €1000 ETF portfolio in Europe looks like this:

- Choose one broad global equity UCITS ETF (MSCI or FTSE).

- Pick one bond UCITS ETF (euro government or euro corporate).

- Check domicile, replication method, TER, share class and spread.

- Stop there.

Adding complexity doesn’t improve a €1000 portfolio — it dilutes it.

Costs, Risks and Taxation

With a €1000 ETF portfolio in Europe, costs and taxes matter earlier than most beginners expect. Even small differences — in TER, spreads or tax treatment — accumulate quietly over time. And because small portfolios have little buffer, inefficiencies show up fast.

Let’s break the essentials into three clean parts.

The Real Cost of Owning ETFs

TER (Total Expense Ratio).

Core UCITS ETFs typically sit somewhere between 0.07% and 0.20%. It’s an orientation range, not a rule. But the contrast with niche products charging 0.50–0.60% is meaningful. Long-term studies from ETF providers show that cost drag becomes one of the strongest predictors of net return.

Brokerage fees and spreads.

Some platforms charge commissions, others don’t — but spreads always exist. A narrow 0.05% spread barely shows up. A wider 0.20–0.30% spread on a thinly traded ETF does. Execution costs live in the spread, not just the fee table.

A simple, illustrative example assuming 6% annual growth:

- Low-cost UCITS ETF (TER 0.12%) → ~€1,770 after 10 years

- Higher-cost ETF (TER 0.60%) → ~€1,640 after 10 years

This is a simplified illustration, not a projection or guarantee. But it highlights why beginners benefit from keeping costs tight.

Understanding Risk Beyond the Index

Market volatility.

Equity ETFs follow markets up and down. UCITS rules ensure transparency, not insulation from downturns.

Over-diversification.

Adding too many ETFs — especially with overlapping holdings — produces complexity without better outcomes. A €1000 ETF portfolio in Europe works best with two or three clear positions.

Currency exposure.

Many broad ETFs are priced in USD. If the euro strengthens, the EUR value of your USD exposure shrinks. It’s not inherently good or bad; it simply adds another moving part. EUR-hedged ETFs exist, though they tend to cost slightly more.

Thematic volatility.

Themes such as clean energy, AI or biotech can swing sharply. They function best as small satellites (often under 10–15%), not as the foundation of a small portfolio.

Taxation in Europe: A Moving Target

Tax treatment varies widely by country, account type and investor status. The following points are general patterns rather than universal rules.

Dividend taxation.

Irish-domiciled UCITS ETFs that hold US equities typically face roughly 15% US withholding at fund level, based on the US–Ireland treaty. After that, many European countries tax dividends again at the investor level. Typical headline rates often fall in these ranges:

- Germany: ~26%

- Italy: 26%

- France: 30% flat (“prélèvement forfaitaire unique”)

- Spain: ~19–26% progressive

Actual outcomes depend on residence, allowances, reporting rules and tax wrappers.

Double taxation is a common scenario unless reduced by treaties or local investment wrappers (PEA in France, Freistellungsauftrag in Germany, etc.).

Capital gains.

Many large EU markets often fall somewhere in the 25–30% range for retail capital-gains taxation, but details vary significantly — exemptions, holding periods, loss offsets and special accounts all influence the final rate.

Acc vs Dist.

In many countries, accumulating ETFs defer taxation of reinvested dividends until sale, while distributing ETFs trigger tax each payout cycle. But this differs across jurisdictions, so the benefits are situational rather than universal.

Estate tax risk.

Holding US-listed ETFs can expose non-US investors to US estate tax above $60,000 in assets. UCITS ETFs avoid this, though the exact treatment always depends on treaties and personal circumstances.

Case Study: Pierre from France

Pierre started with a distributing ETF tracking the S&P 500. Each dividend was taxed at the standard 30% French rate before he could reinvest it. Later he switched to an accumulating UCITS ETF, allowing dividends to compound inside the fund until he sells. It’s an illustrative example of how tax timing — not just tax rate — affects long-term growth.

A €1000 ETF portfolio has little margin for inefficiency. Prefer lower-cost UCITS ETFs, stay aware of possible double taxation, consider accumulating share classes in high-dividend-tax countries, and watch how FX exposure feeds into your returns. Tax rules evolve frequently, and their application depends on individual circumstances — for personalised decisions, checking official sources or consulting a tax professional is always the safer route.

Realistic Return Expectations for a €1000 ETF Portfolio in Europe

Most beginners approach investing with one quiet question — How much can this realistically grow? It’s natural, but also where expectations often drift. A €1000 ETF portfolio in Europe can compound meaningfully over time, yet the path is rarely smooth and almost never follows the tidy lines seen in marketing charts.

A bit of grounding helps.

What Markets Have Delivered Historically

Broad global equity indices such as MSCI World or FTSE Developed World have historically produced roughly 6–8% per year over long periods before fees and taxes. Bond markets sit lower, often 1–3%, depending on rates and credit conditions.

These are orientation ranges — long-term averages, not promises. Some years surge, some disappoint. That’s the nature of markets.

What That Means for a €1000 ETF Portfolio

Here’s a simplified illustration of how €1000 might evolve over 10 years under different market environments:

- Cautious scenario (4% annual return): ~€1,480

- Moderate scenario (6%): ~€1,790

- Optimistic scenario (8%): ~€2,160

These are illustrative calculations, not forecasts or guarantees. Real portfolios experience volatility, taxes, fees and irregular returns — the chart in practice is far messier.

Still, the point stands: modest growth compounds into something noticeable.

Why Behaviour Often Beats Performance

Once the first €1000 is invested, behaviour starts shaping outcomes more than index selection ever will.

Two investors with the same ETF can diverge sharply depending on whether they:

- stay invested during downturns

- avoid chasing hot themes

- rebalance periodically

- contribute regularly

A small example: adding €50 per month to that same 6% scenario turns ~€1,790 after 10 years into more than €8,000. That’s not the market — that’s habit.

Most newcomers underestimate this.

The Currency Question

For euro-based investors holding USD-exposed ETFs, FX movements matter:

- A stronger euro reduces euro-denominated returns.

- A weaker euro boosts them.

Over short periods, currency swings can dominate. Over long horizons, the effect often softens — but it remains another moving part, especially noticeable in small portfolios.

What “Realistic” Really Means

A realistic expectation for a €1000 ETF portfolio in Europe looks something like this:

- returns that fluctuate, not glide upward

- a long-term average in the mid-single digits

- stretches of boredom, occasionally interrupted by stress

- outcomes driven more by discipline than by finding the “perfect ETF”

The market can compound your savings — but only if you give it time.

Everything above is an educational framework, not a projection or guarantee. Actual outcomes depend on market conditions, fees, taxes, FX effects and your own behaviour as an investor.

Market Trends and the Future of ETFs in Europe

By mid-2025, European ETF assets reached around $2.7 trillion, based on industry sources such as ETFGI and Lipper. Monthly data oscillated between roughly $2.74T and $2.87T through the summer — a reminder that AUM shifts with markets and FX. Still, the trend is unmistakable: Europe’s ETF ecosystem keeps scaling, and beginners feel the benefits directly through tighter spreads, broader choice and steadily falling costs. Even a €1000 ETF portfolio in Europe participates in that structural shift.

Expansion of the ETF Ecosystem

Several developments in 2025 strengthened the infrastructure behind UCITS ETFs:

- Euronext ETF Europe. A cross-border initiative unifying order books across Amsterdam, Paris and Milan to reduce fragmentation and improve liquidity.

- Broker innovation. Fractional investing and near-zero commissions continue to spread. (Trade Republic offers fractional ETFs; DEGIRO focuses on low-cost execution but does not provide fractions.)

- Regulatory nudges. Frameworks such as SFDR and PRIIPs shape disclosure, classification and investor protection — sometimes imperfectly, but directionally positive for retail.

Barriers to entry keep falling. Quietly, but decisively.

The Rise of Active and Thematic ETFs

Active UCITS ETFs remain a small slice of the market — well under 10% of total assets — but they are the fastest-growing category. Double-digit growth rates across 2024–2025 reflect rising interest in rule-guided yet flexible strategies, albeit from a very low base.

Thematic ETFs keep gathering attention as well: defence, clean energy, AI, climate transition. Attractive ideas, concentrated exposures. Their volatility makes them most suitable as small satellites — typically no more than 5–10% of a beginner’s portfolio.

Most investors don’t need more than that. Some need none at all.

The ESG Momentum

ESG ETFs have become a structural part of the European landscape. Industry reports suggest that ESG strategies captured a mid-teens share of net ETF inflows in 2025. Drivers vary — regulation (SFDR), investor preference, institutional mandates — but the footprint is real.

The category itself is broad: from low-carbon variants of mainstream indices to stricter exclusion-based screens. Labels alone can mislead; methodology matters far more.

Macro Forces Behind ETF Growth

ETF flows respond to the macro environment as much as to investor behaviour:

- Higher interest rates boosted demand for bond ETFs with newly attractive yields.

- Inflation cycles supported inflows into equity and commodity strategies.

- Volatility and geopolitics encouraged investors to prefer diversified, rules-based exposure over single-stock risk.

These forces rarely move uniformly, but together they help explain why ETF adoption accelerated across Europe.

Snapshot: European ETF Trends (2025)

- Market size: ~$2.7T AUM (FX-sensitive, directional).

- Growth: comfortably above 20% year-on-year.

- Active UCITS ETFs: <10% of assets, but fastest-growing slice.

- ESG ETFs: ~15% of net inflows.

- Thematic ETFs: defence, AI, clean energy, climate themes gaining share.

These figures are approximate, but the direction is consistent.

Case Study: Anna from Germany

Anna, 32, began investing €1000 in 2023 through a broad global UCITS ETF. As brokers expanded fractional access and execution costs continued to compress, she added a modest ESG thematic exposure as a satellite — not as a replacement for her core holdings. Her portfolio grew mainly because she contributed steadily, not because she chased themes.

Active and thematic ETFs will likely continue expanding as investor preferences diversify. But for most beginners, broad, low-cost passive UCITS ETFs remain the cleanest and most tax-efficient foundation. Trends evolve; the core stays surprisingly stable.

Conclusion

The European ETF landscape has never been broader, cheaper, or more accessible — yet the core principles for beginners remain almost stubbornly simple. A €1,000 ETF portfolio doesn’t need complexity to work; what’s actually interesting is that most long-term success comes down to just a few decisions: how much you invest, how consistently you contribute, and how calmly you handle market ups and downs.

The ETF industry keeps growing, new trends appear, thematic funds come and go — but low fees, broad diversification, and a clear portfolio structure still outperform most “smart” tactics. That’s the part many people overlook.

And one more uncomfortable truth: the differences in returns between similar ETFs are often smaller than the impact of taxes — or your own behaviour. That’s why a small, clean UCITS portfolio often looks simple — because simplicity is exactly what makes it work.

For beginners, 2026 brings more options than ever. But the real difference usually happens only when investing becomes a habit, not a one-off decision.

Key Takeaways

- Simplicity wins. Two or three UCITS ETFs are enough for global diversification with €1,000.

- Costs matter more than appearances. A TER below 0.20% and tight spreads matter more over time than a “hot” theme.

- UCITS beats US-listed ETFs for most European investors due to PRIIPs rules, taxes, and asset protection.

- FX risk is real. USD-denominated ETFs carry currency risk; hedged versions exist, but they aren’t necessary for everyone.

- Thematic and active ETFs have a role, but only as a small satellite — not the portfolio’s foundation.

- Taxation shapes net returns. Differences between countries (Germany, Italy, Spain, France, etc.) can matter more than differences between ETFs.

- Behaviour beats optimisation. Staying invested and contributing regularly usually works better than constantly tweaking the portfolio.

FAQ — €1000 ETF Portfolio in Europe (2026)

Yes. A €1000 ETF portfolio in Europe can already cover global equities and bonds through 2–3 low-cost UCITS ETFs. UCITS funds are designed to provide instant diversification, so even small portfolios benefit from broad exposure.

There’s no universal “best,” but beginners typically start with:

a global equity UCITS ETF (MSCI World, FTSE All-World),

a Eurozone bond UCITS ETF,

optionally a small ESG or thematic satellite.

The key is low cost (TER <0.20%) and high liquidity.

Most beginners use a simple split such as 70% global equities + 30% bonds. It keeps costs low, avoids over-diversification, and allows easy rebalancing. Too many ETFs add no real benefit at this size.

Not for European retail investors. US ETFs lack the PRIIPs-required KID and are therefore blocked by EU brokers. UCITS ETFs provide the same underlying exposure but with EU regulation, clearer tax treatment and no US estate tax risk.

If you live in a high dividend-tax country, accumulating ETFs often make compounding smoother because dividends are reinvested inside the fund. Distributing ETFs pay out cash that may be taxed immediately. Local rules decide the best option.

Long-term historical averages for broad equity indices sit around 6–8% per year, while bonds hover around 1–3%. Real results vary widely. That’s the uncomfortable truth — yearly returns jump, but the long-term trend smooths out.

Dividends may face withholding tax at the fund level (often ~15% for US equities inside Irish UCITS ETFs).

Capital gains are taxed locally when you sell (e.g., ~26% Germany/Italy, 30% France, 19–26% Spain).

Always check national rules or tax-advantaged accounts where available.

Only in small doses. Thematic ETFs can be volatile and concentrated. For a €1000 ETF portfolio, themes should be a 5–10% satellite, not the core. Broad UCITS index ETFs remain the foundation.

Popular EU-regulated platforms include Trade Republic, DEGIRO, Scalable Capital, eToro. Some offer fractional ETF investing; others prioritise low fees. The best choice depends on: spreads, FX costs, available UCITS ETFs, and ease of use.

Once per year is usually enough. A €1000 ETF portfolio doesn’t need monthly maintenance — previše je buke, premalo koristi. Annual rebalancing keeps the equity/bond split aligned without unnecessary trading costs.

Matias Buće has a formal background in administrative law and more than ten years of experience studying global markets, forex trading, and personal finance. His legal training shapes his approach to investing — with a focus on regulation, structure, and risk management. At Finorum, he writes about a broad range of financial topics, from European ETFs to practical personal finance strategies for everyday investors.

Sources & References

EU regulations & taxation

- European Commission / Taxation & Customs — ESMA oversight

- FX exposure

- Key Information Document (KID)

- PRIIPs

- SFDR

- TER

- UCITS framework

- UCITS rules

- Irs.gov — US estate tax

- KPMG — ETF ecosystem

- Oecd.org — Capital gains

- dividend withholding

Additional educational resources

- Assets.contentstack.io — Thematic ETFs

- Borsaitaliana.it — Borsa Italiana

- Cashmarket.deutsche-boerse.com — Xetra

- Efama.org — EFAMA

- Etfgi.com — $3 trillion mark later that year

- ETFGI

- Funds-europe.com — European ETF assets

- Ishares.com — bond ETFs

- iShares Core MSCI World UCITS ETF (IWDA/SWDA)

- iShares Core S&P 500 UCITS ETF

- justETF — accumulating (Acc) vs distributing (Dist)

- Amundi MSCI Europe ESG UCITS ETF

- euro government bond ETF

- iShares Core Euro Corporate Bond UCITS ETF (IEAC)

- Physical replication

- Synthetic replication

- Xtrackers Euro Government Bond UCITS ETF – EUNA

- Live.euronext.com — Euronext

- Lseg.com — global equity UCITS ETF

- Msci.com — ESG ETFs

- MSCI World

- Spglobal.com — S&P 500

- S&P Global 1200

- Vanguard.com.au — core–satellite approach

- Vanguardinvestor.co.uk — Vanguard FTSE Developed Europe UCITS ETF (VEUR)